The man who pioneered one of the country’s initial on-demand storage companies has shifted his focus to the technology behind the business.

That means the storage companies that were once competitors of Boxbee are now its potential customers.

Powered by Boxbee

Recognizing opportunity, Boxbee founder and CEO Kristoph Matthews sold the full service storage side of its business to Iron Mountain and Corovan earlier this year to focus on building and marketing the proprietary software behind it. To Matthews, the valet storage space was becoming “really fragmented, really fast,” so he shifted the focus of his New York based company.

“We decided this was a better way to scale and serve our market,” he said.

Founded by Matthews – who has a PhD from Cornell – in 2012, Boxbee has received funding from Google Ventures, Lucas Venture Group, Floodgate and Metamorphic Ventures.

“We are now using the software we used to manage our own business in the past to other storage companies wanting to offer pick up and delivery services,” he said.

Turnkey pick up and delivery

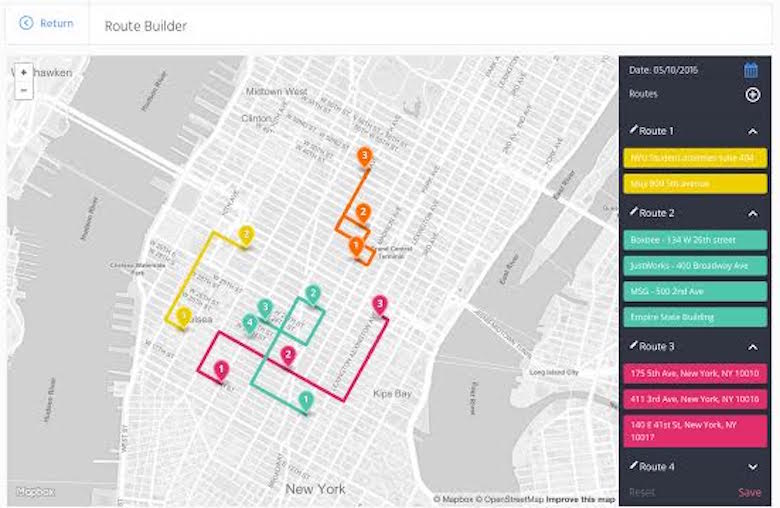

Boxbee now offers everything from a branded website to a billing interface as well as mobile apps for workers in a warehouse to keep track of items being stored. Other features include the ability to set driver routes based on appointments and manage stored inventory in a safe, secure way.

The software also features a mobile app for drivers to see their routes, appointments and customer information while en route.

“We can help with all the things required to run a business like this,” he said, “so that companies can have software to run a company from end to end rather than using multiple providers and piecing them together. Plus, companies have the flexibility to customize and personalize the product in the way they see fit.”

Burgeoning industry

Matthews believes it’s difficult to quantify just how big the full service storage market is. Some view it as a direct competitor to traditional self-storage while others view it as an ancillary service.

“From our own observations, the numbers keep getting better with every month more people interested in offering this service,” he said. “It’s definitely fast-growing and we’re very optimistic about how fast this industry is going.”

Currently, Boxbee has several customers using its software in a closed beta testing environment.

“We’re being very selective and careful about who we bring on board to represent our platform,” Matthews said.

Staffing up

As part of the rebranding, Matthews has brought in a new team of software engineers, product managers and sales staff as well as new leadership including former Etsy executive Dev Tandon as COO. Prior to joining Boxbee, Tandon led the development of Etsy Wholesale, Etsy’s B2B marketplace that connects Etsy sellers who can wholesale with small boutiques and large retailers such as Nordstrom, Whole Foods and West Elm.

Boxbee is the only company in the industry offering such a product at this time, Matthews believes.

The on-demand economy

IBISWorld estimates that storage revenue in the U.S. self-storage industry climbed to $32.6 billion in 2015 from $29.8 billion in 2014. It forecasts it will increase to $32.7 billion in 2016.

Meanwhile, the on-demand economy is attracting more than 22.4 million consumers annually and $57.6 billion in spending, according to new data from the National Technology Readiness Survey (NTRS) as reported by Harvard Business Review. The NTRS data shows that while men are still the most prevalent consumers of the on-demand economy (55%), 45% are women. Not surprisingly, almost half (49%) of on-demand consumers are millennials (age 18-34), but 30% are between 35 and 54, and 22% are age 55 or older.

The data also shows that 46% of on-demand consumers have an annual household income of less than $50,000, and only 22% have an annual household income of $100,000 or more.

And, research firm CB Insights reported that investment activity in on-demand mobile services rose 514 percent to $4.12 billion in 2014 compared with the year prior. Funding in just the first four months of 2015 totaled $3.78 billion.