A New York startup believes payroll data provides a more accurate view of self-storage demand than the industry’s long-held focus on population metrics.

Union Realtime will soon unveil a technology offering, called Genesis, for self-storage owners/operators that tracks payroll data and other metrics to help them make business decisions such as where to acquire or develop new self-storage facilities or to analyze demand at an existing portfolio.

The company recently released a related report, “Unpacking the Truth about Self-storage Demand: Why the Industry May Have it Wrong.”

“We looked at population growth and saw that it wasn’t really changing much, yet the fundamentals of the self-storage industry changed significantly through the downturn,” said James de Gorter, co-founder of Union Realtime LLC.

Follow the money

The advisory firm determined job relocations were one of the main drivers of self-storage demand.

“We came to the conclusion that payrolls were the metric to be tracking if you want to know what is going on with demand in self-storage,” de Gorter said.

The consultancy formed about a year ago to advise hedge funds and mutual funds on their investments into publicly traded self-storage REITs. Its new data offering refocuses the consultancy’s efforts on serving the self-storage industry.

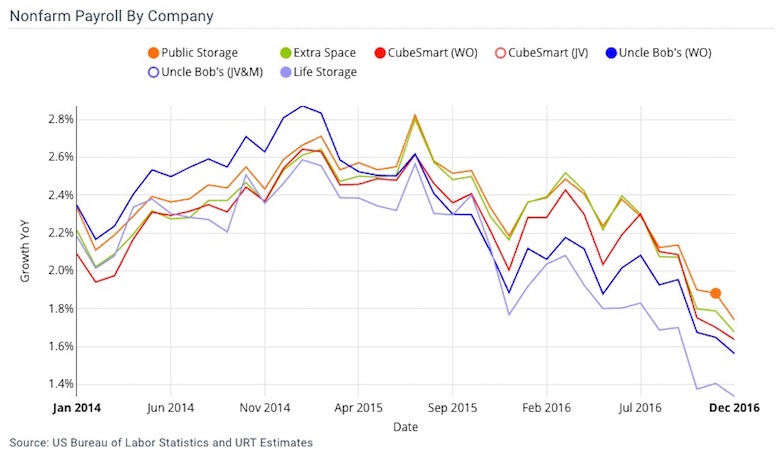

Union Realtime believes two key metrics are superior to population metrics when comes to evaluating the storage industry: Labor force flows and nonfarm payrolls. Labor force flows track the gross number of people changing jobs while nonfarm payroll data showcases the number of paid U.S. workers. Nonfarm payrolls can be tracked monthly down to the regional level.

The report found that revenue of the self-storage REITs has “a 97% correlation to nonfarm payroll indicating that an increase in the latter will mirror an increase in self-storage revenue.”

Despite their differences, the two metrics are 98% correlated as economic expansion drives higher employment rates (payroll growth) and creates a more stable environment for the currently employed to take more risk and find new jobs (labor force flows). -Union Realtime report “Unpacking the Truth About Self-storage Demand”

Union Realtime has researched more than 50 MSAs in which the self-storage REITs operate and is available to do similar analyses for privately held self-storage operators.

Genesis will provide digitized information on more than 40,000 self-storage facilities in North America. Combined with an easy-to-use Internet interface, owner/operators will be able to study statistics within a particular area, such as a 3-mile radius, from their existing or planned facilities. There will be datasets that include pricing and promotion information, traffic counts and other demographical data.

Union Realtime calculated the exposure of the big four storage REITs to changes in nonfarm payroll over time.

“We plan to create company specific payroll charts like we did for the public REITs,” de Gorter said. “The user would enter his property addresses and we can track for any private company. We would require their revenues to analyze the historical correlation.”

Worth a close look

Chris Sonne, executive vice president of the Self Storage Valuation Group at CBRE, said the idea of using payroll data to measure demand “is very interesting and merits more study.” Sonne said he’d like to see the analysis tested beyond the REITs, which command less than 20% of the highly fragmented self-storage market. He also wondered whether the data could be applicable to small trade areas, which account for much of self-storage facility demand.

“Demand can vary significantly in two trade areas, even in the same city,” Sonne said. “In our analysis of MSAs and trade areas, to calculate stabilized demand, we analyze four variables: population, percentage of renters, average household income and average household size. It can be scaled from MSA analysis to a trade area for both REITs and small operators,” Sonne said.

de Gorter said there isn’t payroll data by trade area, only by MSAs, but once Union Realtime maps all facilities into its technology, it will be able analyze square footage, price and population metrics at the trade level.

Union Realtime’s existing product, Advocate, is for investors of the publicly traded self-storage REITs. Advocate tracks pricing, promotions and construction data on 15,000 publicly traded self-storage REITs with weekly updates.

Population metrics still matter

Union Realtime wants to stress that it isn’t throwing out population metrics, de Gorter said. Population metrics can be helpful and well suited for developers and acquirers who analyze absorption of new supply, he said. It’s a piece in the puzzle, but may not tell the whole story.

Developers typically want to develop in areas of low self storage per capita, but even if a market only has 2 square feet of self storage per capita it doesn’t necessarily mean the market is undersupplied.

“I would look at 2 square feet of storage, but you’d also want to build in areas of job growth where people are coming into the area over a multiyear period,” de Gorter said

De Gorter said initial feedback from the industry of its new product has been strong.

“We are hoping it (Genesis) will be a hub for the self-storage industry to gather information and do research on new site selection and portfolio analysis,” de Gorter said.