It is one of the most active markets for self-storage development, and still one of the most undersupplied. But new regulation may bring storage construction to a halt.

Unless a last-minute compromise is reached, some industry officials say it now appears likely that New York Mayor Bill de Blasio’s proposed zoning restrictions on new self-storage facilities will take effect later this year in the Big Apple, putting a damper on construction and handing current facility owners a monopolist-like advantage in setting rental prices.

Eighteen months ago, the de Blasio’s administration unveiled a proposal to carve out 21 new “Industrial Business Zones” (IBZs) within current manufacturing districts, requiring new self-storage facilities and hotels to get special permits to build new, or convert existing, facilities.

The idea is to try to preserve old manufacturing properties – and blue-collar jobs – in the city, mainly in the Bronx, Queens and Brooklyn boroughs.

New York Mayor Bill deBlasio announcing proposed restrictions on storage development in November 2015.

Plans on ice

Though alarmed by de Blasio’s move, industry officials expressed hope the administration would listen to their concerns and alter key aspect of the IBZ proposals. But the mayor’s office just recently filed roughly the same plan, starting the clock ticking toward permanent changes being implemented by possibly later this year, unless a compromise is reached.

“My clients are pessimistic,” said Seth Peyser, a partner at TAA Properties, a commercial real estate firm. “For all intents and purposes, people think this is the new reality. It will make doing business in New York more challenging.”

Indeed, Peyser said the market, even though the new rules haven’t taken effect yet, is “now in limbo” and “flux,” as some deals grind to a halt amid fears they’ll never pass regulatory agencies once the zoning changes take hold.

Working out a deal

Others disagree that the market has already ground to a halt. If anything, they see dozens of deals being rushed along in an attempt to get grandfathered under current zoning provisions, before the new rules take effect – if they take effect.

Still, no one disagrees the IBZ provisions, once officially enacted, will hit the industry hard in New York.

“This is essentially a new ban on self-storage in some area,” said Michael Woloz, a lobbyist at Connelly McLaughlin and Woloz, which represents Safe N Lock, a self-storage developer in New York. “The new criteria are so impossible that far less will get built.”

Woloz is more optimistic than Peyser that a final compromise can be reached before the end of the year, basing his outlook on the opposition to the deBlasio plan among a handful of city council members and business groups, especially those in the Bronx, Queens and Brooklyn.

Insatiable demand

With the rules looming over the industry, two things seem clear: New York desperately needs more self-storage facilities and owners of existing facilities could make out like bandits if future supply is chocked off.

According to a recent CBRE report, the New York metropolitan area has 3.5 square feet of self-storage space per person, not even half the national average of 7.2 square feet per person, making New York the “most underserved market” in America.

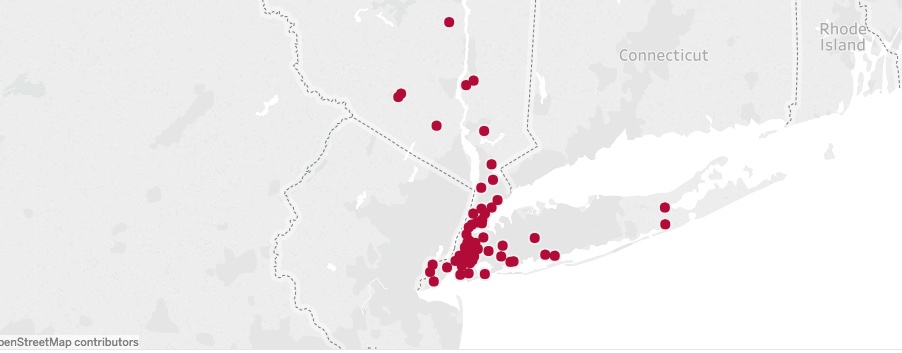

A study by Cushman and Wakefield reports that there are now two to three million square feet of self-storage space in the planning pipeline in the New York area. Research by SpareFoot and Big Byte Insights identifies more than 50 projects either under construction or in the planning stages in the New York metro area:

But that many is far from enough for NYC to achieve supply-demand parity with the rest of the nation, in terms of square footage of self-storage space per person.

A boon for local operators

And if future supply is chocked off, or seriously curtailed, the big winners will be owners of hundreds of existing self-storage facilities in New York, says James de Gorter, a partner at Union Realtime, a New York real estate research and consulting firm.

“They’ll have that much less competition,” he said. “They’ll be able to charge higher prices due to the restrictions on supply.”

If the current projects now in the pipeline are built, an extra 40,000 units or so will help temper price increases in the short-term, he said. In the long-term, though, New York needs much more supply, he said. Rents in New York, according to various sources, have risen by about 20 percent in the past five years alone.

Some consumers may instead opt to store their stuff with one of several startup companies offering valet-like pick up and delivery services in the city such as MakeSpace, Red Box and several others that offer similar pricing to traditional self-storage.

Finding a way

Industry officials say self-storage construction won’t come a complete halt, if and when the new rules are imposed. New York generally has three types of property classes: Residential, commercial and manufacturing/industrial. It’s still conceivable that some facilities could be built in unchanged commercial and manufacturing districts – and in IBZs themselves.

But Peyser notes that most of the new IBZ districts were carved out of the M-1 light-manufacturing subcategory of manufacturing districts – and those are the very zones that have recently seen most of the self-storage activity in recent years, he said. Those zone are generally near mixed-use residential and retail neighborhoods, the very areas self-storage owners want to be near, he said.

De Gorter said residents seeking affordable, conveniently located self-storage facilities will get hit hard by the new rules. But so will small businesses that use self-storage lockers as sort of mini-warehouses, he said.

“A lof of people are going to suffer – developers, lenders, small businesses – and it’s going to be negative for consumers,” he said.