Tenant Length of Stay (LOS) is a commonly used success metric for the self-storage industry, ultimately measuring the total time a tenant spends renting a unit at a facility, from move-in to move-out.

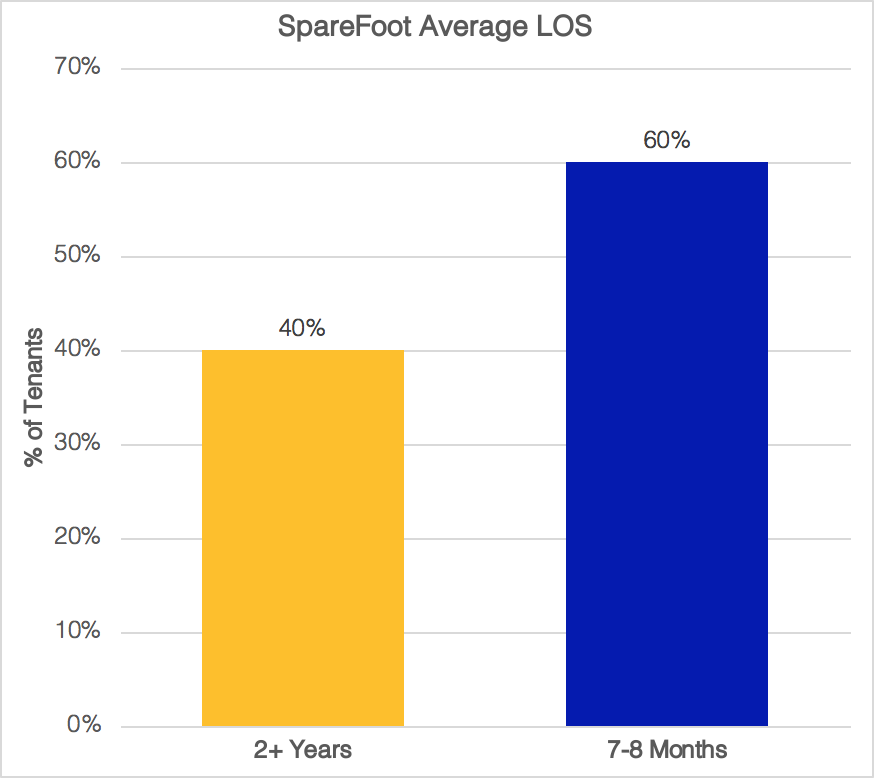

SpareFoot research has shown that a good average LOS is 7-10 months. But, LOS can also get pretty complex—so we interviewed our top data experts to help break down LOS, why it’s important, and how you can create a successful analysis on your own.

Why is LOS so important?

LOS is an essential component in calculating the value each tenant brings to your business. Knowing what your tenants are worth allows you to make an informed decision on how much you can afford to spend in order to acquire a new tenant.

Many operators already have a good understanding of this concept, and in turn are out there spending a little more for each tenant because they know it will pay off in the long run. So, if you don’t know your LOS or how much you can afford to spend, then you’re already at a disadvantage.”

What do you see as the biggest challenge in calculating LOS?

The definition of what you’re trying to measure with your LOS calculation is very important—what is the application of the analysis you’re doing? Whether you’re talking about LOS for an individual, for a given unit size, or an average LOS for rentals coming from a specific marketing source, this will play a huge role in how you shape your analysis. You’ll want to make sure you refine your numbers so that they will work best for your particular use case.

For example, if you’re calculating LOS to better understand your marketing costs and return on investment, you’ll first want to make sure you can accurately attribute your tenants to their respective marketing channels. If you don’t have a clear way to delineate between these channels in your reporting in the first place, then you’ll want to start there.

What if you’ve already got clear channel attribution—then what?

Next, you’ll want to organize your LOS data at the level of what’s being measured. In most cases, this is done at a tenant-level to identify and understand LOS patterns for specific cohorts of tenants. And if you’re doing a tenant LOS, you have to consider that a tenant may stay in multiple units (or transfer between units), which would cause their actual LOS value to be greater than the value of an individual unit.

Built-in tools in many facility management software programs don’t consider this fact. SiteLink does and calculates LOS at a unit-level rather than a tenant-level. This unit-level LOS can distort a marketing channel analysis, because customers will stay in multiple units, and/or return multiple times over a longer period, and/or transfer between units.

For example, if you’re looking at a unit-level LOS for a tenant who stayed 6 months then transferred and stayed another 6 months, the LOS will calculate as 6 months in your software but should actually be a 12 month LOS. When SpareFoot conducts LOS analyses, we like to consider unit transfers at a tenant level.

Another big challenge is the traditional long tail decay, or lack of visibility into the future to determine LOS for current tenants. You have to be able to attribute or segment a weighted value to tenants who are still in their units, and may be for years to come—who probably make up a significant percentage of your tenant base and will most likely increase your average LOS.

There are a ton of other things that can also impact your LOS calculation—from seasonality (LOS varies based on the time of year the rental occurs), to facility age (has the facility been around for less than a year, more than 10 years, etc.), and facility geography and demographics.

Once you have this knowledge, what do you do next?

Once you’ve got all your parameters set up and you know your data is “clean,” calculate the lifetime value of each tenant to assess your return on investment, for each marketing channel (ROI = total revenue earned – total cost of investment). That way, you can compare apples to apples with your channels and decide if you’re getting your money’s worth with your marketing spend. Are you okay with spending a couple of months’ worth of rent in order to acquire a customer that stays for at least 7-8 months?

Once you’ve made a decision, you can shift your budgets intelligently toward marketing channels that provide the best return on your investment.