When people outside Texas think of the Dallas-Fort Worth area, what springs to mind could be the region’s oil and gas industry, its booming real estate market or even its NFL franchise, the Dallas Cowboys.

What may not come to mind is Dallas-Fort Worth’s self-storage industry, which ranks as the largest in the country in terms of physical size.

We have been actively evaluating D-FW for new opportunities, and there are certainly pockets within each submarket that appear overbuilt.

— Robb DeJean, director of development, The Jenkins Organization

The 2015 Self-Storage Almanac shows the Dallas-Fort Worth region had 1,138 facilities in 2014, the most of any U.S. metro area. That’s a bigger number than the more populated metro areas of Los Angeles, CA (1,072), New York City, NY (1,067), and Chicago, IL (920).

Houston, which is Dallas-Fort Worth’s downstate rival in everything from football to energy, clocks in with 1,018 facilities, the almanac shows. Nearly 7 million people live in the Dallas-Fort Worth metro area, with almost 6.5 million in the Houston metro area.

Facilities on tap

Another 45 self-storage facilities are in the building or planning stages across the vast Dallas-Fort Worth area, according to Paul Darden, president of the Paul Darden Co., a Dallas-based company that specializes in self-storage brokerage, management and development.

Roughly four to five of those projects will be Public Storage “supercenters” totaling 200,000 to 300,000 square feet each, according to Darden. The publicly traded self-storage REIT said in February that it had a pipeline of 25 development projects spanning 3 million square feet across the U.S.

“It will be interesting for people who have to [rent self-storage] within five miles of those supercenters that Public Storage is putting in,” Darden said.

Alluring growth

Michael Johnson, a real estate broker at Austin, TX-based Bellomy & Co., attributes Dallas-Fort Worth’s lead in self-storage facilities to the rapid growth it’s seeing in population and jobs.

“That makes it attractive for storage operators,” Johnson said. “When they’re looking to develop or acquire, they’re looking for job and population growth.”

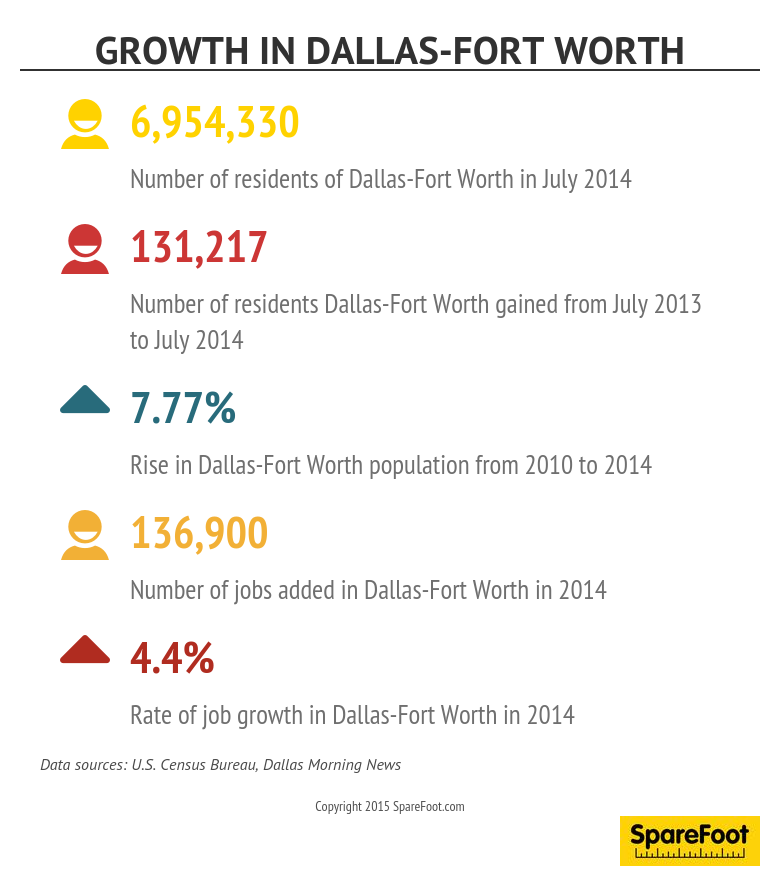

A recent Dallas Morning News story reported that the Dallas-Fort Worth metro area added 131,000 people between July 1, 2013, and July 1, 2014. That was the second highest number of new residents for any metro area in the country, behind only Houston, the newspaper reported.

Meanwhile, the federal Bureau of Labor Statistics reported earlier this year that Dallas-Fort Worth ranked first among the 12 largest metro areas for the rate of job growth and third for the number of jobs added.

“Whether people are moving into or out of town, all you need is people whose lives have mobility,” said self-storage broker Aaron Swerdlin, Houston-based executive managing director of NGKF Capital Markets. “Any area where you see an influx of population, that will be a huge driver of storage.”

Swerdlin noted that Dallas-Fort Worth’s population is spread over a large swath of land, unlike places like New York or San Francisco, CA, where residents are densely packed. The Dallas-Fort Worth area, known as the “Metroplex,” covers nearly 9,300 square miles — about the size of New Hampshire.

“With D-FW being two markets that have grown into one, the mass of geography drives the total count [of self-storage facilities],” Swerdlin said. “There is a large population spread across a large area.”

Rising costs to build and buy

A first-quarter 2015 report from commercial real estate company Cushman & Wakefield puts self-storage occupancy in Dallas-Fort Worth at 84.8 percent.

“Some operators are higher than that,” Swerdlin said. “The sharing of information in self-storage is very behind the curve.”

In addition to major chains like Public Storage bulking up in Dallas-Fort Worth, many smaller operators are building or buying their way into region, attracted by business fundamentals such as the relatively low number of employees that self-storage requires and the industry’s reputation for being resistant to economic downturns, experts say.

All of that is driving up the cost of getting into Dallas-Fort Worth’s self-storage market.

For what Johnson calls “run of the mill” Class A space using basic elements such as concrete and steel, construction costs now run around $45 to $50 per square foot, he said. Other expenses — ranging from land to “soft costs” such as architects, lawyers and engineers — can ratchet up the price of a self-storage development.

“We typically budget well over $100 per square foot for development,” said Robb DeJean, director of development at The Jenkins Organization, a Houston-based self-storage operator.

The prices that Dallas-Fort Worth self-storage facilities are fetching vary by a host of factors, such as the submarket and the amenities. Experts say local facilities are selling for anywhere from $60 per square foot on the low end to as much as $150 per square foot, although some deals have breached the $200-per-square foot barrier.

“Over the last 12 months, prices have been going up in a big way,” Johnson said.

Glut on the way?

The booming activity in Dallas-Fort Worth’s self-storage market has raised fears that a bubble could be forming. In fact, the Cushman & Wakefield report classifies the market as oversupplied at 7.88 rentable square feet per person, compared with the national average of 6.5.

“We have been actively evaluating D-FW for new opportunities, and there are certainly pockets within each submarket that appear overbuilt,” DeJean said.

Share this image on your site

Low interest rates and relatively easy access to capital are fueling “intensive development,” DeJean said. Simultaneously, self-storage is seeing a wave of money pouring in from development groups and private equity players that lack experience in the field, he said.

“We are experiencing and bracing for a glut of self-storage,” DeJean said.

Other experts share DeJean’s concerns.

Johnson thinks the self-storage sector in Dallas-Fort Worth generally is healthy now, in part because so little development happened between 2009 and 2011. But, he added, “we’re 12 to 18 months from seeing signs of being overbuilt.”

Staying in shape?

On the other hand, NGKF’s Swerdlin said lenders have tougher requirements for extending credit on self-storage developments than was the case amid the economic boom of the past decade.

“Lenders want to see real cash equity, unlike the last time,” he said. “It takes a lot of developers out of the equation.”

Swerdlin worries, however, about what could happen if lenders get more aggressive with construction financing for self-storage.

“We’re in good shape for that now,” he said. “The question is whether we will stay that way.”