In a new class-action lawsuit, a Florida man alleges self-storage operator Public Storage deceived customers who bought tenant insurance policies.

The suit, filed in federal court in Miami, seeks restitution for all of the insurance premiums paid to Public Storage by its customers over the past four years, an amount that potentially could total hundred of millions of dollars.

The plaintiff, Colin Bowe, alleges that Public Storage sold tenant insurance to him and other storage consumers without properly disclosing that the company retains a “substantial portion” of the premiums. The suit claims that the insurance program offered by Public Storage is “a hidden profit center for itself that kicks back unconscionable profits at the expense of consumers.”

Coral Gables, FL, law firm León Cosgrove is representing Bowe, who rented a unit at a Public Storage facility in Miami.

Alleged ‘deception’

“They tell consumers [the premium] is a pass-through cost and they will play no role in the insurance of the consumer’s goods,” the firm’s founding partner, Scott Cosgrove, told The SpareFoot Storage Beat. “Meanwhile, they are taking an enormous chunk, if not all of it, and we think it is a deception.”

Representatives of Public Storage could not be reached for comment. The REIT is scheduled to file its response to the suit in early June.

Holland & Knight of Miami and Newport Trial Group of Newport Beach, CA, are representing Public Storage in this case. Attorneys with the two law firms could not be reached for comment.

Cosgrove said the suit is open to all Public Storage customers who bought insurance from the company during the past four years. Public Storage sells hundreds of thousands of insurance policies each year, with 700,000 issued in 2012 alone.

Insurance profit

The sale of insurance policies is high-margin source of revenue for Public Storage. As noted in the company’s 2013 financial report, the company grossed $84.9 million from the sale of tenant insurance policies in 2013. Of that, $67.8 million was net profit.

Public Storage’s insurance revenue rose 8.8 percent from 2012 to 2013. The number of customers buying policies also has been on the rise. In 2011, 61 percent of the REIT’s customers bought insurance policies marketed by Public Storage. In 2013, that number increased to 65 percent.

Still, revenue from tenant insurance remains a small portion of the company’s total revenue. In 2013, the company racked up revenue of $1.85 billion, with just 4.6 percent of that coming from tenant insurance.

The fine print

Public Storage requires all of its tenants to carry insurance. Customers are not required to buy the coverage offered by Public Storage; for instance, customers in many cases can rely on their homeowner’s or renter’s insurance policies.

However, the suit alleges that the company encourages employees to aggressively sell insurance and that employees are provided with scripted sales language.

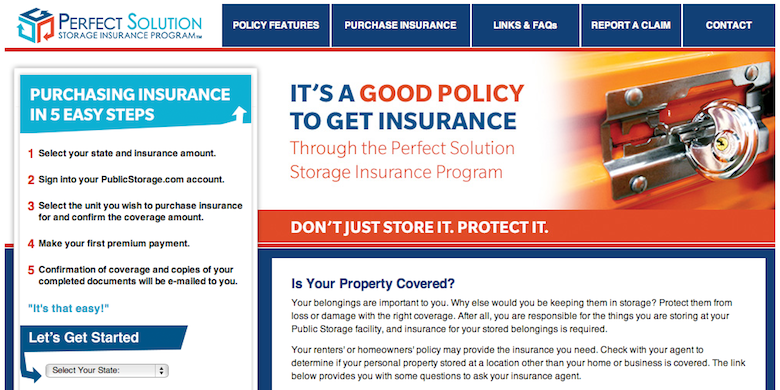

The coverage offered by Public Storage, called Perfect Solution Storage Insurance, is underwritten by New Hampshire Insurance Co. The suit claims that the premiums are excessive compared with similar policies and that there’s no correlation between the underwritten risk and the premium amounts. New Hampshire Insurance is not a defendant in the suit.

Perfect Solution Storage’s cheapest policy in Florida costs $11 a month for $3,000 worth of coverage, according to the suit. By contrast, $4,000 worth of coverage from U-Haul’s recommended insurer, SafeStor, goes for $6 a month in Florida.

The suit says Bowe and other customers who bought tenant insurance received a contract addendum authorizing Public Storage to “conduct the administrative function of receiving premium to send to the insurance company on my behalf.”

The premium appears as a line item on monthly statements for Public Storage customers. According to the suit, the statements are designed to lead customers to believe the premiums are collected by Public Storage and fully passed on to the insurance company. In fact, the suit claims, Public Storage “enriches” itself by retaining much of each premium.

Similar case

Cosgrove compares his client’s lawsuit against Public Storage with another legal case in Florida. Cosgrove said in that case, Costa Cruise Lines line invoiced customers for a port charge. Part of the port charge did go to the port, he said, but the cruise line also kept a portion.

“The cruise line became liable for that fee because they had provided an impression to the consumer that they were collecting that fee on behalf of a third party,” Cosgrove said.

The suit against Public Storage contains five counts: violation of the Florida Deceptive and Unfair Trade Practices Act, breach of contract, unjust enrichment, breach of covenant of good faith and fair dealing, and unconscionability.

Self-storage attorney Jeffrey Greenberger says tenant insurance is a good idea for storage consumers.

Another perspective

Self-storage industry attorney Jeffrey Greenberger of Cincinnati law firm Katz Greenberger & Norton said he isn’t convinced that Public Storage did anything wrong in this case. Greenberger is not involved in the suit.

“What really made me scratch my head is that [the suit] relies very heavily on this idea that people were basically forced or received this hard sell into insurance,” Greenberger said. “Of course, they want you to buy their insurance and it is profitable for them, but you could still have your own [coverage].”

Greenberger said tenant insurance is a good idea for consumers because deductibles on most homeowner’s and renter’s policies are too high to cover a total loss of contents in a storage unit.

“If my deductible is $2,500 and I agree to a $3,000 value limit at Public Storage and I had a complete loss, I’d get $500 back, at best,” Greenberger told The SpareFoot Storage Beat.

Greenberger said it’s common for self-storage operators to collect insurance premiums on behalf of insurers. Then, the insurers typically return a portion of the premiums to the operators in the form of marketing or administrative fees.

Greenberger compares Public Storage’s tenant insurance program with coverage offered by rental car companies.

“If it turns out to be the case that you aren’t allowed to recommend your own insurance to people … a lot of other businesses would be in bad, bad shape,” Greenberger said.