Recent earnings reported by the big four publicly traded self-storage REITs show a continuing trend of unprecedented industry growth. A lack of new development has led to record high occupancy rates at REIT-owned properties. This, in turn, has let the REITs to push rental rates up while generating more revenue.

Combined revenue for Public Storage, Extra Space Storage, CubeSmart and Sovran Self Storage (Uncle Bob’s) surpassed $3 billion in 2013. That figure is up 38 percent compared with 2009. Combined net operating income (NOI) — a key financial barometer for self-storage REITs — climbed more than 61 percent over the same five-year period to a total of $1.3 billion. Public Storage leads the pack, with $1.98 billion in revenue last year and NOI of $962 million.

Peak occupancy

Glendale, CA-based Public Storage also leads when it comes to occupancy and rental rates. The company recorded an annual average occupancy rate of 93.3 percent in 2013, which helped lift realized rents to $14.13 per square foot.

For the four REITs combined, average occupancy has risen more than 10 percent over the past five years to more than 90 percent among same-store locations. Looking at the REITs together, the average realized rent for the companies hit $12.93 last year, 8 percent higher than five years ago.

The REITs’ numbers for 2014 could be even more impressive.

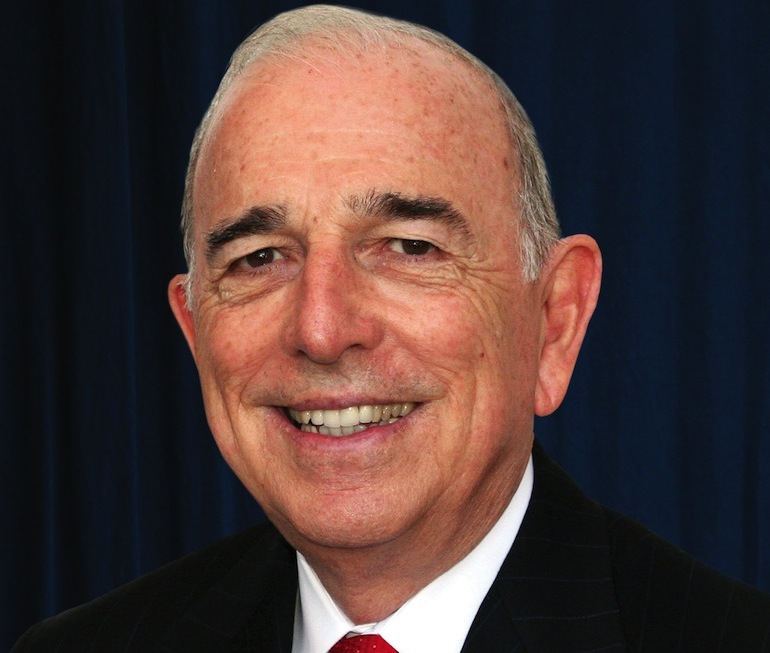

“There is very little development in the pipeline that would in the least way affect this rental season,” said Dean Jernigan, principal of self-storage financial advisory firm Jernigan Capital and former CEO of CubeSmart. “This will be a very strong rental season, and the public companies should get some nice street rate increases.”

Jernigan said the REITs are likely to see higher occupancy rates this year. In fact, they could be “higher than we ever thought before,” Jernigan said, reaching an average of 95 percent in June or July.

Public Storage achieved an average occupancy rate of 94.4 percent in the third quarter of 2013 — a rate higher than the three other REITs.

Subdued development

One key component supporting previously unseen occupancy levels is the dearth of new development over the past several years. Construction spending on self-storage construction and expansion projects peaked in 2007 at $1.3 billion. By 2011, that figure had dropped to $241 million, according to the U.S. Census Bureau.

Development spending has crept up since then, reaching $530 million last year. An increase in supply that would be large enough to threaten the new occupancy norms remains a few years off, Jernigan said.

“I think it will be next year, probably 2016, before we see any development that starts to impact the performance of REITs, but it will still be negligible,” Jernigan said. “It won’t be like the levels of development as we have seen in the past.”

About 220 new facilities are on the books for this year, according to a report from Chicago-based real estate services firm MJ Partners. Principal Marc Boorstein said that figure is about double the number of planned projects reported at the beginning of 2013.

“Development is going very slowly. It is not for lack of interest; it’s a lack of financing,” Boorstein said.

Lenders still holding back

Shawn Hill, principal of self-storage capital advisory firm The BSC Group, said banks are extremely picky when it comes to development loans. Only borrowers with a track record of success, equity, proper capitalization and access to prime real estate have a chance of securing a development loan.

Banks are turned off by the amount of time it takes for new facilities to reach stabilized occupancy, according to Hill. Compared with other types of commercial development such as retail and office, with developers holding letters of intent or signed leases, self-storage is entirely speculative.

“Self-storage developers have to tell the story that it is going to take three of four years to lease up,” Hill said. “That’s a hard sell.”

Michael Mele, vice president at real estate brokerage firm Marcus & Millichap, said that finding suitable sites is another obstacle to development. Self-storage developers “are competing against McDonald’s and Target for those sites,” he said.

While the REITs have the resources to develop facilities, their activity still is restrained. Boorstein said that’s because it’s made more sense for them to add square footage through acquisitions.

“Their revenue management has gotten so much better. They can take a stabilized portfolio with 85 percent occupancy and get it to 90 percent, and there is much less risk,” Boorstein said.

Public Storage, for instance, is exploring some new development, with 18 ground-up construction projects on the books. Combined with redevelopment of existing facilities, Public Storage already has a development pipeline pegged at $196 million. It plans to add up to another $100 million to that pipeline during the course of 2014.

The specter of new supply

Boorstein said a surge in new development is perhaps the only thing that could threaten the record high occupancy levels for the REITs. Since it takes so much time to find a site, secure financing, obtain entitlements and complete construction, Boorstein said the current environment isn’t likely to change for at least four years.

“If financing opens up, all bets are off,” Boorstein said.

Mele of Marcus & Millichap said a sudden surge in supply won’t affect just the REITs.

“If developers are able to come up with a significant amount of new product, it will definitely put the brakes on growth. Being a realist, sooner or later it has to happen,” he said.

Such a shift would hit small operators the hardest, as REITs are more sophisticated when it comes to attracting and keeping tenants, Mele said.

The tide that lifts all units

While the shortage of new development has empowered REITs to maximize occupancy and push rates to new levels, that doesn’t mean other large and midsize operators are being left in the dust. Boorstein said private operators also have benefited from current conditions.

“Private operators have caught up a lot. On average, there is a 3 percent occupancy gap between REITs and non-REITs. They haven’t caught up completely, but it has been a big shift in two years,” Boorstein said.

Mele said mom-and-pops also are making headway, but their occupancy rates typically lag those of competing REITs by 5 percent to 10 percent.

“The REITs have marketing call centers and an Internet presence,” Mele said. “It is really tough for individuals to compete.”

Even if their occupancy rates don’t match those of the REITs, private operators still could raise rates this year, Dean Jernigan said.

“It takes some courage,” Jernigan said. “Many of them haven’t hit firm peak occupancies yet.”

“You can increase both occupancy and rates at the same time,” he added, “and that is what they should be doing this year.”