Moving to a new home in the same town is simple enough, at least when it comes to paperwork. But moving to a new state all together presents a fresh set of challenges. You’ll have to acquaint yourself with an entirely different set of laws and regulations, which could be quite different from what you are used to at your previous location.

But becoming a resident of a different state can be a thrilling and exciting adventure, and hopefully come with a new job, new friends and a new lease on life.

To make relocating to a new state easier, we’ve put together a handy guide featuring all the aspects, major and minor, that you should consider prior to making your long distance move.

Planning Your Move

The first thing you will want to do is to plan your actual move itself. With your new location in mind, consider these two options to ensure a happy moving experience—the do it yourself method or hiring moving services.

Relocating your own belongings can be a positive experience. Yet, it’s important to plan your strategy well in advance (a month or more) as it typically involves reserving a one-way U-haul or other rental truck. Plus, by comparing rental prices, you can quickly decide which moving truck is right for your relocation budget.

As mentioned, your other option is to hire a moving company. Handing the reins over to professional movers is viable for many reasons—hassle-free packing, no lifting heavy boxes, problem-solving equipment, etc.

Another tip when choosing professional movers is simply to pay attention to reviews. According to Zillow, once you verify a moving company’s legal status, recommendations hold their weight when it comes to sizing up their reputation. For an interstate move you will want to look for a moving company that is registered with the Federal Motor Carrier Safety Administration.

Updating Your Documents

Living a new state means it’s time to update your important documents. From government agencies to financial institutions, you’ll want to stay on top of this.

Most importantly, notify the U.S. Postal Service of your change of address. Otherwise, your mail may have a difficult time finding its way to your new address. Remember, the post office will only forward your mail for one year after you move (some mail for only 60 days).

Additionally, take a trip to your local Department of Motor Vehicles to get your new driver’s license. Keep in mind that different states have different requirements. Your new city may have a limited time frame in which to update your driver’s license without a penalty as well.

While at the DMV, you can revise your vehicle registration to keep your ride current (and legal). May as well check a few things off your to-do list by registering to vote, if that’s available.

Updating Your Insurance

States regulate insurance differently, so you will likely need to change all of your insurance policies to new ones. Insurance companies are often happy to cross states lines, but agents are usually only licensed in one state.

Still, a good place to start looking for a new policy is with your current insurance agent. They will be able to locate another agent with the same insurance carrier in your new location. Again, asking for recommendations from friends or family is invaluable.

Car insurance can frequently present the biggest difference in premium cost. Prices may vary greatly, even in different parts of the same state. Furthermore, be mindful of important renewal dates—insurance renewal and license plate renewal—using these as a benchmark for launching new auto insurance coverage.

Depending on whether you rent or buy in your new state, you’ll need to shop around for either homeowners insurance or renters insurance. Again, your current agent as well as a real estate agent can help to point you in the right direction.

Formerly, health insurance was an enormous obstacle when moving to a new state. Thanks to the Affordable Care Act (ACA), however, most of those troubles are in the past.

Nevertheless, it’s important to be aware of enrollment periods and possible coverage gaps during the moving process. If you’re also starting a new job, talk with your Human Resources representative. Or, you can talk with a knowledgeable health insurance broker for more information.

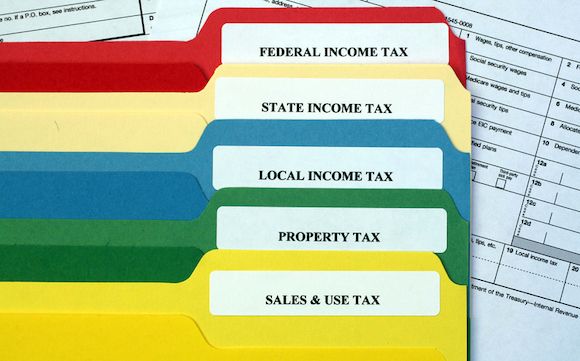

State and Local Taxes

Tax laws vary from state to state so you will need to learn quickly. First of all, try not to panic about tax season. Mostly, because your federal tax return won’t even be impacted by your move. Plus, filing two state tax returns isn’t as daunting as it sounds.

A good place to start is learning whether your new state collects an income tax. Some states don’t; which, makes it easier for you. Tax preparation software programs such as TurboTax or H&R Block typically do the heavy lifting for you, assuming you provide accurate information.

Another tax to consider is your personal property tax, or otherwise known as your car tax. It’s not uncommon for states with no income tax to have a higher personal property tax. In this case, you will likely be required to pay additional sales tax. Or, make up the difference between the two states depending on the value of your car.

Taxes have a way of tottering, balancing out each other like an old mercantile scale. As mentioned, states with higher taxes in one area are often lower in another. Property taxes are no different. For this reason, it’s important to know how your new property taxes measure up as each state is different.

Buying a Home

If you are buying a home in a different state before you move, you’ll need to work with a real estate agent in that state.

When it comes to getting the inside scoop on a neighborhood, school district, or even a moving company, your real estate agent is the go-to resource. After all, it’s their job to be sort of a local “know it all.”

Additionally, negotiating and handling contracts can be difficult tasks. Turning to a real estate agent will help gain you full access to information that may otherwise be tricky to get.

Although some people are fully able to sell and purchase a house, a real estate agent serves as a local liaison. Ultimately, they help you navigate the complicated stuff when it comes to buying a house in a new state.

Other Considerations

In addition to updating all your official information, you’ll need to change a few personal profiles as well. And your phone number may need to be number one on the list.

When looking for a new job, having a local area code increases your chance of a potential new employer contacting you. The same goes for your LinkedIn profile. On the other hand, some people become attached to their old phone number or aren’t looking for work. In this situation, changing your number may not need to be a priority.

Before you relocate, it’s recommended that you do your research on the new area. Of course, it’s impossible to really get familiar with your new surroundings until you live there. Though, keep exploring at the forefront of your mind.

Even with a firm grasp on your new local cost of living, it may take you several months to choose a regular grocery store, the route to work, convenient gas station, etc. Give yourself time to get used to your new city’s culture.

Remember, government and political dynamics can vary greatly from state to state, too. Consider the norms of a red state versus a blue state, for example.

Also, pay special attention to differing state laws and regulations upon arriving at your new place—licensed professions, marijuana, small business environment, etc.

With a hefty dose of organization and research, moving to a new state can be a thrilling experience. So, put your learning cap on and start packing. Most importantly, have a happy moving experience!