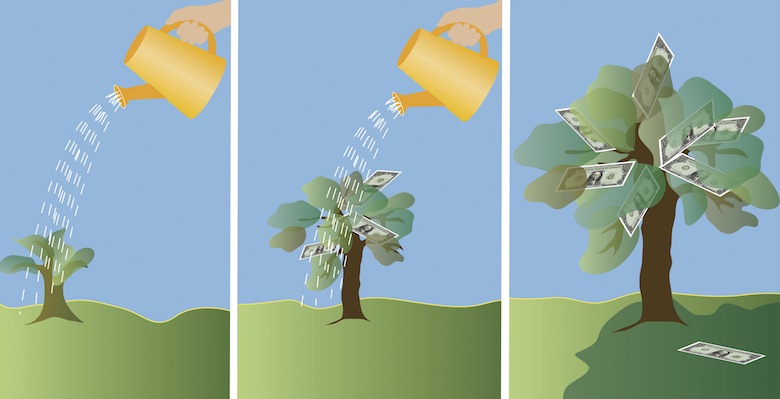

The future of self-storage just got a little greener. Raleigh-based SLI Capital and Charlotte-based Madison Capital have joined forces to acquire a controlling interest in GreenSpace Self-Storage. The company, renowned for its pioneering approach to constructing...