A new crop of full-service companies is looking to revolutionize storage in urban markets, but CubeSmart CEO Christopher Marr doesn’t seem to be too concerned.

“We are skeptical of the long term competitive nature of that as it relates to self-storage,” Marr said during the company’s quarterly earnings conference call.

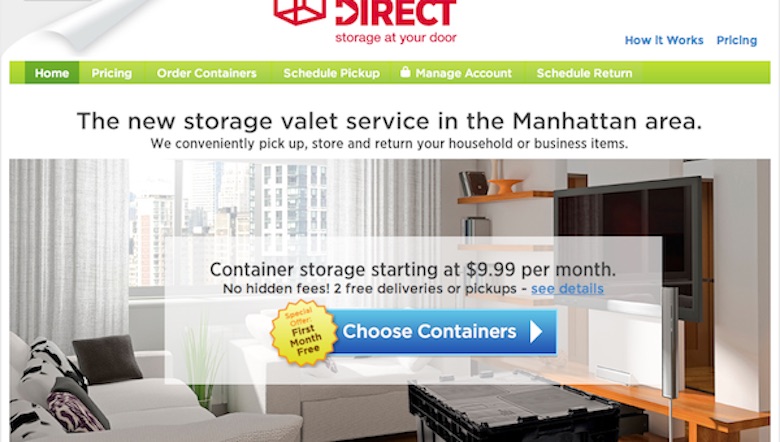

Full-service storage companies offer pick up and delivery of customers’ belongings, which are most commonly stored in a secure warehouse. New York City, where CubeSmart is the largest self-storage operator, is home to several of these new startup companies.

Unprofitable opportunity?

Marr said his dim outlook for full-service operators, also known in the industry as valet storage, comes from personal experience. CubeSmart launched its own version of valet storage in January 2014 called CubeSmart Direct. The pilot program was available in New York City and customer’s belongings were picked up and stored in storage units at its facilities in the Bronx and Brooklyn. The company halted the program after a few months.

“We learned that it moved pretty quickly into most of the customers seeking a full scale moving and storage experience,” Marr said. “We learned that the logistics involved in the business, not to mention the parking tickets, created an unprofitable opportunity.”

Marr said he expects full-service to remain a niche business with a few players existing in urban markets—but far from becoming a threat to the supremacy of traditional self-storage.

“I don’t see it, and the guys on the ground don’t see it,” Marr said.

New development watch

Marr is also keeping an eye on new development, which so far seems to be putting little, if any pressure on CubeSmart.

Looking at CubeSmart’s top seven markets (New York City, Chicago, Baltimore-Washington, Dallas-Ft. Worth, Miami-Ft. Lauderdale and Boston) there were 28 new facilities opened that weren’t controlled by CubeSmart, of those only eight compete directly with a CubeSmart location.

“From a supply perspective…we remain very comfortable with the overall supply in these markets,” Marr said.

Tale of two cities

Marr said New York in particular remains undersupplied despite continued development activity in the market. Marr said there are 14 facilities under construction or permitting in the New York boroughs; only four will compete with a CubeSmart facility.

“There would have to be significant new supply way beyond what we see today for that market to be any concern,” Marr said.

If any of those markets are of any concern it would be Dallas, where more than 30 new storage facilities are slated to open.

“When you look at where things appear to be moving in volume the quickest, it’s clearly the Dallas-Ft. Worth area,” Marr said.

Marr said that market currently provides 7.9 square feet of storage space per person, higher than the national average of 7.35 square feet per person. By comparison there is only about 1.5 square feet per person in Brooklyn.

Development activity

Meanwhile the company continues to grow its number of new facilities via agreements to purchase facilities at certificate of occupancy from regional developers.

During the first quarter CubeSmart closed on one such facility in Brooklyn for $48.5 million. The company also opened a $31.8 million new facility in Queens with a joint venture partner.

CubeSmart currently has five facilities under contract to purchase upon completion for a total of $64.2 million: two in Texas, two in Illinois and one in Florida. In addition, the company has four facilities under development with joint venture partners in New York, Washington D.C. and Florida.

Joint venture expansion

The company invested a small stake into a joint venture by the name of “HVP” to acquire a 31-property portfolio for $115.5 million. CubeSmart already managed the portfolio prior to purchase. The company will invest a total of $10.7 million into the joint venture. The HVP partnership was previously formed last year to acquire 37-properties from Storage Pros Management.

Revenue climbs

CubeSmart boosted revenue during the first quarter 14.6 percent to $118 million. Net income rose 85 percent to reach $15.8 million.

Revenue at the company’s same-store locations grew 8.6 percent, while income grew 12.9 percent. The Malvern, PA-based REIT benefitted from a 6.8 percent increase in realized rent per square foot, $15.11 during the quarter.

The company saw occupancy rise as well, ending the quarter at 92.3 percent compared to 91 percent the previous year.